Table of Contents

What is the Rule of 72

When you want to find out how long until an investment will double your money, you only need to know one thing: The Rule of 72.

The Rule of 72 is an easy way to calculate the period of time it will take for funds to double based on a fixed interest rate by simply dividing 72 by that rate.

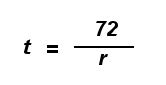

The Rule of 72 Formula

For people who prefer to see it visually, the Rule of 72 formula is:

Take for example, the average annual rate of return for the S&P 500 is about 10% over the past 30 years (link). According to the rule, money invested in the S&P 500 index fund will double in about 7.2 years since (72 / 10 = 7.2)

Using algebra, you can calculate the rate of return needed for your investment to double by dividing 72 by the time period. For an investment to double in 4 years, you would need to earn 18% annual interest.

Accuracy of the Rule of 72

The Rule of 72 formula provides a reasonably accurate estimation of the time needed for money to double in value.

Since the number 72 is easily divisible off the top of your head by the numbers 2, 4, 6, and 8, it is a quick way to give an estimate without needing to pull out a calculator.

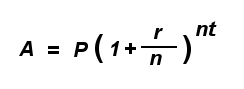

To calculate the exact time needed for money to double, you need to use the compound interest formula.

The compound interest equation is:

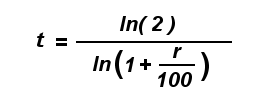

To calculate time, the compound interest formula becomes:

Here is a comparison of the results between using the Rule of 72 and the Compound Interest formula to see how they stack up.

| Interest Rate r | Rule of 72 Calculation time = 72 / r | Compound Interest Calculation time = ln(2) / ln(1 + r/100) |

| 1% | 72 | 69.7 |

| 2% | 36 | 35.0 |

| 3% | 24 | 23.4 |

| 4% | 18 | 17.7 |

| 6% | 12 | 11.9 |

| 8% | 9 | 9.0 |

| 10% | 7.2 | 7.3 |

| 12% | 6 | 6.1 |

| 15% | 4.8 | 5.0 |

| 18% | 4 | 4.2 |

| 20% | 3.6 | 3.8 |

The Rule of 72 is most accurate for interest rates between 6% and 12%. Once the interest rate exceeds these percentages, the rule becomes less precise.

When you need 100% accuracy, nothing replaces using the compound interest calculation. But when you need an approximation, the Rule of 72 is acceptable.

Using the Rule for Investment Planning

We all know that the earlier you start saving and investing, the more time you will have for your money to grow. That is the power of compound interest.

Using the rule, you can get an idea of how much money you will have based on your investment returns and time horizon.

For example, you are currently 29 years old and plan to retire when you are 65. You have $100,000 invested today, earning a 10% annual rate of return thanks to the S&P 500.

Using the Rule of 72, you can expect your money to double every 7.2 years. In 36 years, you can double your money 5 times. You can project that you will have about $3.2 million when you retire. Your money will grow from $100,000 to $200,000, then $400,000, $800,000, $1,600,000, and finally $3,200,000.

Closing $ense

The Rule of 72 is an easy way to get a ballpark estimate of how long it will take for your money to double when you know the rate of return. This rule works as long as you get a constant rate of return through the entire period.

For investments such as stocks, where the return rate is variable, you can divide 72 by the number of years you hope for your money to double to get the rate of return needed to achieve your goals.