Many major crypto exchanges charge maker and taker fees for buying and selling cryptocurrency. What are these fees and how do you make sure you are paying the lowest possible fee when placing an order?

Low-volume traders on cryptocurrency exchanges such as Coinbase Pro, Crypto.com, or Binance pay the same fee whether they are a maker or a taker.

However, if you trade often or are trading on Kraken Pro, where the lowest volume tier has a maker fee of 0.16% and a taker fee of 0.26%, then whether you are a maker or a taker will make a difference on your bottom line.

Table of Contents

What are Maker and Taker Fees

Many cryptocurrency trading platforms charge different fees based on the type of orders placed.

- A maker is a trader who provides liquidity to the order book

- A taker is a trader who takes liquidity out of the order book

Being a maker or a taker should not be attributed to being a buyer or a seller. Some people get this confused and think a buyer is taking liquidity from the market. This is not always the case. A trader who is buying a coin can be either a maker or a taker. The situation is the same for a trader looking to sell their coins.

Instead, it is the type of order and how you place your order that determines whether you are charged the maker fee or the taker fee.

An order that gets placed on the order book with a limit order is a maker order. Maker orders do not execute immediately due to a conditional price limit. They “make” the market by providing liquidity. Maker orders get charged the maker fee rate.

Takers place market orders to immediately buy or sell a coin. These market orders take liquidity from the market. The crypto exchange fills the market order with a limit order waiting on the order book. Takers want their trades completed right now so they get charged more for it.

Exchanges reward makers by charging a lower fee. This incentivizes traders to place limit orders on the order book. Without makers, the price of a cryptocurrency can fluctuate wildly as buy market orders get matched with sell market orders.

The greater the liquidity on an exchange, the faster an order gets filled. More liquidity also means tighter bid-ask spreads. These qualities attract high-frequency traders who seek to have their orders executed quickly at the best price.

Order Types and Maker-Taker Fees

Stop Orders

Besides market orders, another order type that will always trigger the taker fee is the stop order. Stop orders are used by traders to buy or sell a cryptocurrency when the price moves against them a certain amount to help protect profits or limit losses.

When the value of a crypto reaches the stop price, the stop order will be executed as a market order.

Stop-Limit Order

For a stop order to not be immediately filled as a market order, you have the option to specify a limit price with your stop order. This is called a stop-limit order.

When a coin’s price reaches your stop price, your stop-limit order will activate a limit order. If your limit order is placed on the order book, you will be charged the maker fee.

Limit Orders and Getting Charged Taker Fees

We know that market orders are always charged a taker fee. Does that mean limit orders are always charged the maker fee?

The answer is no.

The reason is that a limit order gets executed when the coin’s price is at your limit price or better. Should the market suddenly tank as you are submitting your limit order, all or part of your order could immediately execute. The part of your order that is instantly filled will be charged the taker fee rate.

To ensure that you only get charged the maker rate for your limit order, you sometimes have the option to post your order to the order book. Otherwise, the order is canceled.

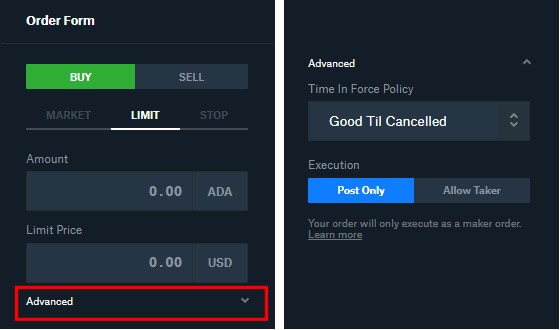

For Coinbase Pro:

Select the Advanced menu when entering a Limit Order. Then under Execution, select “Post Only”.

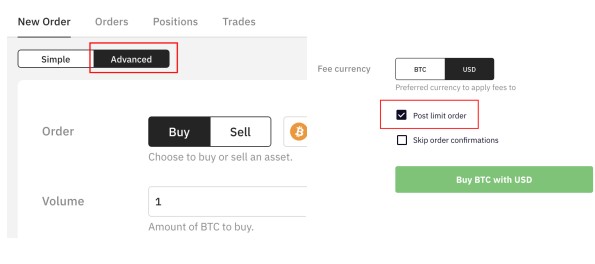

For Kraken Pro:

On the New Order options, click on the Advanced tab and check the “Post limit order” box.

Closing $ense

Hopefully, this article helps you better understand maker fees and taker fees.

With this information, you can decide how much fees you are charged when trading cryptocurrencies at your preferred crypto exchange.

Trading on the exchanges is very similar to trading on stocks brokerages. If you are trading on regular Coinbase or Kraken, you can save big on commissions by switching to the Pro side of the exchanges. To understand how trades are placed, check out my post on how to place orders.