Can you customize your Capital One credit card? I recently came across this question online and it got me thinking about my own Capital One Quicksilver card. I applied for the card almost a decade ago and one of the first things I did was personalize my Capital One card with a custom photo I took of the lake when I lived in Lake Tahoe. I still remember the commercials promoting this neat feature.

Capital One has since suspended and brought back the customization feature multiple times over the years. If you are considering getting a Capital One credit card and are wondering whether you can still design your own card with Capital One today, keep reading.

Table of Contents

Can You Customize Your Capital One Credit Card?

As of September 2024, you cannot customize Capital One credit cards.

When the feature was available, you could change the picture on the front of the credit card every 30 days. Capital One discontinued the service a few years ago without notice. There is no indication when they may bring it back.

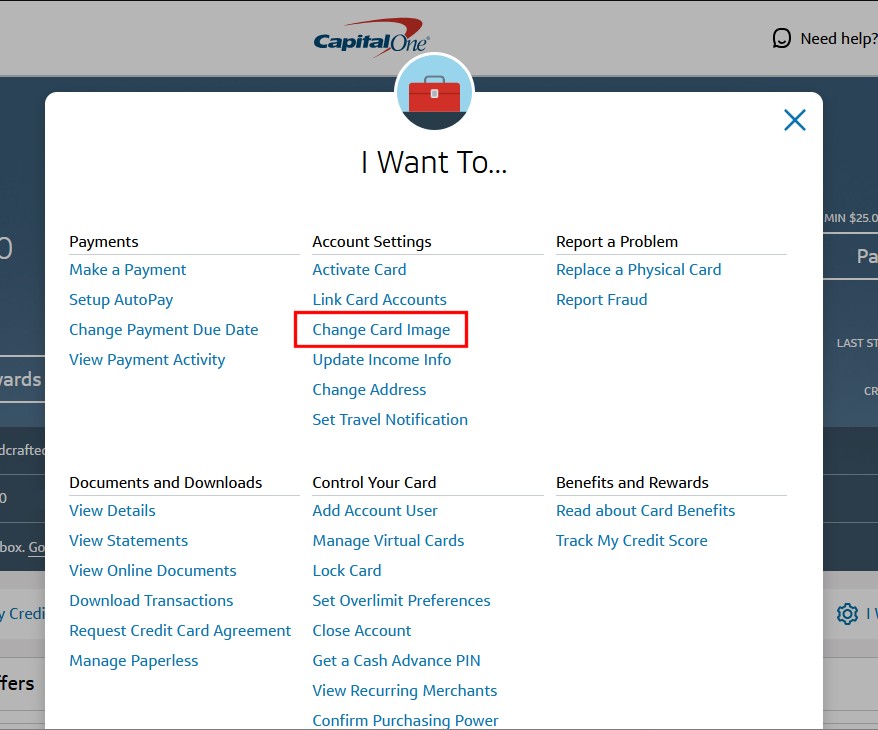

To see whether the card image personalization service is available, you will click on the “I Want To” link with the gear icon on the account summary page. Then look for the “Change Card Image” link under the “Account Settings” section.

People who were lucky enough to catch the service when it was available can still get replacement cards with their current photo. When I added an authorized user last year to the account, the new credit card arrived with the same personalized photo I had on my primary Capital One card.

Why Did Capital One Discontinue Customization of Their Credit Cards

There is no official reason given for why the service to customize Capital One credit cards was discontinued.

There is speculation that Capital One stopped offering the ability to upload a custom image because of the cost or amount of resources required to have a department dedicated solely to manually approving each image before the card was sent to the printers.

The image card acceptance guidelines included almost two dozen stipulations prohibiting any photo that included things such as copyrighted and trademarked material, public figures, flags, firearms, drugs, political statements, obscene content, emojis, memes, and more.

Benefits of Customizing a Credit Card for Issuers

Credit card companies are constantly competing with each other so their credit or debit card is the one customers pull out of their wallet when they check out. Many issuers already offer rewards such as 2% cashback and thousands of airline miles to get people to use their cards. Here are some reasons why banks offer the ability to customize a credit card.

Top-of-Wallet Placement

Credit card customization is a simple way to encourage someone to use a credit card more. People who personalize their credit cards are putting images and things that they are passionate about on the card. They want to set themselves apart from other shoppers and show off some of their personality and interests.

People who toss a credit card into a desk drawer are not going to take the time to customize their credit card. Someone who puts in the effort to put a favorite picture onto the card is more likely to keep the card in their wallet and use the card. Every card swipe earns the issuer interchange fees. Customers who use the card and carry a balance have to pay the credit card company interest.

Customer Loyalty

Credit card customization separates a bank’s credit card from the many other cards in a user’s wallet. Adding personal details such as a unique design or personal photos increases brand loyalty.

There have been reports from people who applied for credit cards from certain issuers only because they could create their own customized credit card with the photo of their cat.

Having a customized credit card is no different than people who apply for metal credit cards such as the Capital One Venture X Rewards, Chase Sapphire Reserve, or the Apple Card.

There are likely thousands of banks offering credit cards and debit cards to their customers. Yet only a small subset of these offers the possibility to personalize your credit card. People who enjoy this feature will likely stick with a bank that offers this ability.

Free Branding Opportunity

You might think a bank having their logo or name featured prominently on the front of their credit card is good for marketing and branding.

Everyone knows about Wells Fargo, American Express, Chase, or Capital One. A generic credit card design with the issuer’s name will not attract much attention or elicit a response.

Each time someone flashes their custom credit card featuring their pet, newborn, sports team, favorite musician, Disney character, or vacation destination, they invite people to talk about the photo and credit card. Each time this happens is a marketing opportunity for the credit card issuer.

Dangers of Customizing Your Credit Card

Credit and debit cards already have your full name on them. Putting anything personal on your credit card can give thieves and fraudsters additional information about you and be a security risk.

Someone who finds only your credit card on the street can use your name to do an internet search to learn more about you. If your picture is on the card too, it makes it easier for them to know they have the right person if they find your Facebook or LinkedIn profile.

Putting a family photo, pictures of your car, or your house on your credit card might seem harmless. However, displays of perceived signs of wealth could make you an even bigger target should your wallet be lost or stolen. With the address from your license, you could be setting yourself up to be a burglary or home invasion victim.

Pictures of locations and pets may also provide hints to answers for security questions for online accounts. Using the name of your first pet is a popular question on many websites. If your dog’s tag is readable on the front of your credit card, people may have the answer in the palm of their hand.

Other Credit Card Companies that Allow Customization of their Cards

Here are a few credit card issuers and banks that allow their customers to design and customize their cards.

Wells Fargo

Wells Fargo allows customers with eligible credit cards and debit cards to customize their cards through the Card Design Studio Service.

According to Wells Fargo, debit cards that are ineligible include The Private Bank cards, ATM deposit cards, Campus Cards, and ATM cards.

Credit cards not eligible for customization include the Autograph, Active Cash, Reflect, Cash Wise, The Private Bank, and Wells Fargo Advisor cards.

Other than those specific cards, you can customize any credit card as long as it’s listed as Eligible in the Card Design Studio and the account is in good standing. Even authorized users can get their own customized card. For business cardholders, both employees and business owners can customize their own cards.

Regions Bank

Regions Bank allows its customers to personalize their personal and business debit cards, personal credit cards, and Now Card. However, the Wealth Visa Signature credit card is not eligible for personalization.

You can upload your own photo or select from many on their design gallery with the Regions YourPix Studio.

There is a fee of $10 for each time you design and order a new card.

Truist Bank

Truist customers can order a unique personal debit card with their design that they upload or choose one from hundreds of professional photos in their image library. This feature is available at no additional cost.

Cards eligible for customization include the Truist personal or small business debit cards. The Delta SkyMiles debit cards are not eligible.

First Bank & Trust

First Bank & Trust account owners with a consumer checking account can upload their favorite photo or choose from a large image gallery of professional photos. This includes primary and secondary account holders and any authorized signers.

Each custom image debit card costs $9.95 and the fee will be deducted from your primary checking account for the debit card. You can change the image on your debit card as often as you want with the $9.95 fee charged for each occurrence. You will also have to pay the fee again every three years when your debit card expires.

Custom Designed Credit Card Skins

When your bank doesn’t let you choose your own graphic on the front of your credit card, you can go online to sites like Amazon and buy skins with pre-designed graphics or upload your custom designs and photos and receive a skin that can be applied to any credit or debit card.

After uploading your image or selecting a graphic, you will receive pre-cut vinyl skins for your card in the mail. These are similar to stickers but can be easily applied to your card. When you want a new style, you can peel off the old skin leaving no residue, and apply a new one.

Closing $ense

Capital One is currently not offering credit card customization services. There is no telling when the service might be back after it was discontinued.

Customizing your credit card isn’t a must-have feature for many people. Some customers enjoy placing their favorite photos of their pets or cherished memories on their credit cards where the sight of it will bring a smile to their face or the cashier’s.

Have you had a credit card that you’ve added a picture on the front of? Do you know of any other issuers that allow credit card customization?