Market crashes will happen. Here are four things you should do to avoid panicking when the market goes from green to red and you start feeling dread.

If you have been paying attention to the news lately, it seems as if everything is imploding all at once:

- Gas prices have been at their highest in decades

- The stock market is down almost 15% for the year

- The crypto market is melting down

- Inflation has been through the roof, as evident by I-Bond rates at 9.62%

- The Fed is raising interest rates at a rapid clip

- There are worries about a recession coming

- We are still in a pandemic and there is a major war

With all the bad news around us, it’s natural to be a little fearful. No one wants to put hard-earned money into the market only to see it vaporize the next day when the market drops another 900 points.

When the markets are crashing, we may want to reduce our investing or stop altogether. Timing the market is a skill even professional traders don’t always get right. Yet we consider doing it because losing money really sucks.

Here are ways to convince yourself to continue investing when the market is down.

Table of Contents

Automate Your Investing

Let’s face it. When you have to actively invest your money, you will forget or skip investing when life gets hectic.

An automatic investment plan lets you automatically transfer and invest a set amount of money from your paycheck regularly.

This can be done by setting up automatic payroll deductions, bank withdraws, or direct deposits to your investment or retirement accounts. Direct deposits from your paycheck can be set up with your employer. Otherwise, many brokerage accounts have the ability to set up recurring deposits from your bank account on a regular schedule.

Next, login to your brokerage account and create a recurring investment schedule that invests the money into your favorite stock, mutual fund, ETF, or crypto.

With automatic investing, you never have to see or think about the money. This avoids the temptation to spend it, attempts to time the market, and reduces the likelihood of overreacting to the market’s fluctuations. Your savings and investing will stay on course while you are busy with life.

You Are Buying at a Discount

One of the greatest investors ever – Warren Buffett, once said “Be fearful when others are greedy, and greedy when others are fearful.”

What he is saying is to be cautious when the markets are booming and everyone is celebrating. The party will eventually end and if you jumped in because of fear of missing out (aka FOMO), you may end up overpaying for an asset. When the markets are falling and everyone is selling and running for the hills, it may present a good opportunity to find great bargains.

The price you pay correlates to the number of shares you get for your money. The pricier a stock, the smaller number of shares you will be able to purchase.

Let’s say you have $10,000 and you want to buy a particular stock and sell after the price goes up $10.

Scenario 1

Stock purchase price: $50

Shares purchased: 200

Stock sold price: $60

Your ROI = 20%. You made $2,000

Scenario 2

Stock purchase price: $40

Shares purchased: 250

Stock sold price: $50

Your ROI: 25%. You made $2,500

Additionally, your returns in the second scenario would be even higher – 50%, if you sold the stock at $60 too.

To get the highest returns, you want to buy low and sell high. There is no better time to buy low than when the markets are sinking. Think of stocks as being on sale when the market crashes.

Think of the Long Term

It may be difficult to watch the value of your portfolio decrease as the markets are dropping.

When you have a well-diversified portfolio such as when investing in an index fund, keep faith that over the long run you will do better to stay fully invested even when you may be tempted to sell and protect your money during market swings.

Take the below chart of the market during the February 2020 COVID market crash. Had you sold at the bottom, you would have taken a loss of 32%. But if you stayed invested, you would have recovered all your losses by August and even made more gains since.

Research shows that those who stay invested over the long term will usually do better than those who try to time the market.

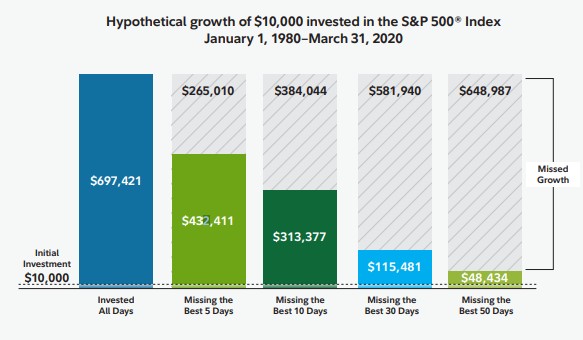

The graph below from Fidelity shows the growth of $10,000 invested in the S&P 500 over 40 years.

Someone who stayed fully invested would have an account with almost a $700,000 balance. Missing just 10 of the best days in those 40 years means they would have earned 55% less.

Remember, investing is a marathon, not a sprint. With a long enough time horizon, you will get to the finish line.

Stop Watching the Market

You’ve set it up so your money is invested automatically no matter what the markets are doing; you have a well-diversified portfolio with passive index funds; you are in it for the long haul. Now what?

Then you don’t really need to know what is going on with the market on a day-to-day basis. You can turn off Mad Money and stop reading all the business news.

It’s no surprise when you open up Yahoo Finance, it is full of alarming headlines. Journalists know that bad news sells better than good news. It generates more attention, leading to more clicks and in turn, more advertising revenue.

When you load the day’s news stories and all you see are stories about the coming recession, high gas prices, bad earnings reports, mass shootings, and new viral outbreaks, it results in a negative outlook of the world.

That’s right. The media companies and news organizations are happily making money while making you depressed.

By going on a low-information diet, you will have less stress and you will be happier.

Closing $ense

The stock market will always go up and down but in the long run, it has only gone up. Since its inception, the average annual return of the S&P 500 is 10.67%.

Trust in the data and continue investing when the market is crashing. Whether you are starting out from college or you’ve been in the workforce for a decade, if you keep your money in the market and continue to add to it, you will likely retire with a very nice nest egg.

What methods do you use to keep investing when the market is crashing? Has it paid off?