Rent-to-own or lease-to-own retail stores are big business. I’m sure you’ve seen their commercials, stores, and even trucks driving around. Without naming names, the two biggest of such companies does multi-billion dollars a year in revenue.

The idea is you make weekly, semi-monthly, or monthly payments that are usually a hundred or so dollars a month to rent an item and after a year or two, the item is yours. Hence, the term “rent to own”.

Get it now, the commercials say. They’ll even deliver it free to your door. You can have that spiffy brand name 65” flat screen TV in time to watch the Super Bowl on and you won’t have to worry about a thing if it breaks while you are renting it because they’ll replace it for free!

You can rent just about anything these days from the rent-to-own businesses: sofas, dining room sets, mattresses, refrigerators, televisions, laptops, stoves, washer and dryer sets, and more for the low monthly fee with no credit checks, down payments, or even bank accounts needed.

Does it sound too good to be true? You betcha.

The only people who should ever consider using these types of businesses should be temporary and short-term renters. By short-term, I mean a month or two. Maybe you are throwing a Super Bowl party and need that 65” television for the big game. Any longer, and it doesn’t make any financial sense.

Table of Contents

Are You Renting-To-Own Furniture, Appliances, or Electronics?

If you are renting or leasing things like ranges or recliners, there is a good chance you can’t actually afford it. That is all the reason why you shouldn’t do it.

This is the reason why the poor stay poor and the rich stay rich. Poor people make bad choices with their money so they have a hard time getting out of poverty.

Take a look at the below screenshot for a laptop at one popular rent-to-own store:

The basic specs is a HP with 17.3” screen size, an i5-8250U processor, 8GB of memory, and 1TB hard drive.

It costs $130 a month to rent the laptop. If you choose to buy it, the six months same as cash price is $1,169. If you lease it for the full 15 months, you’ll own it after paying a total of $1,949. Your total cost to rent is $779.

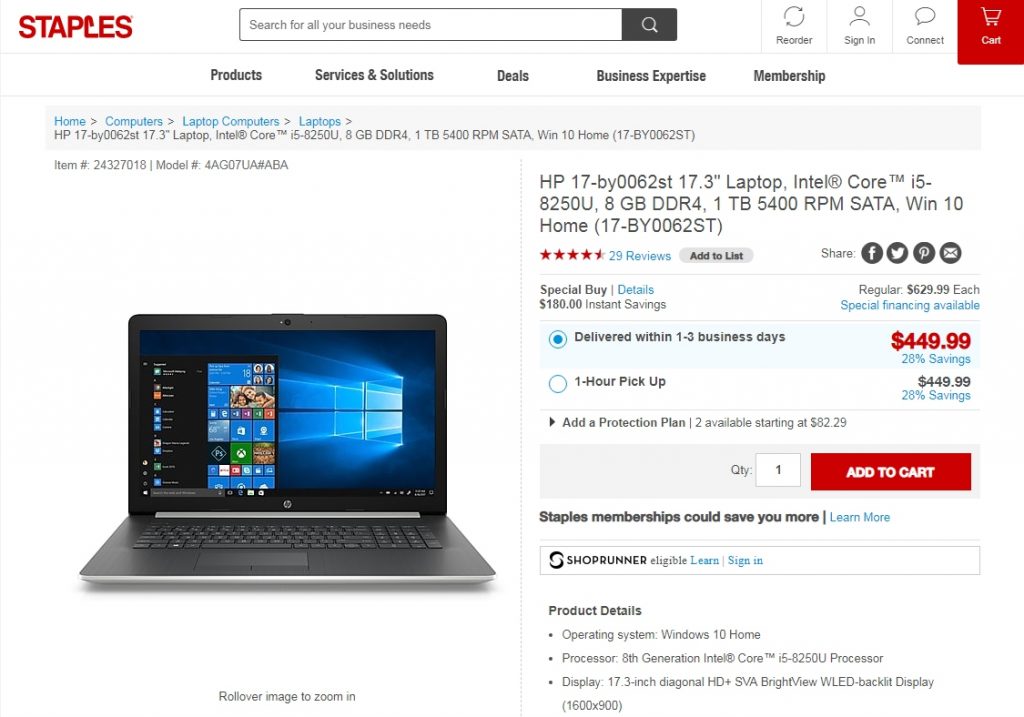

Here is a similar spec’ed HP laptop for sale at Staples:

The price? $629 regular price and $449 on sale!

So not only is buying a laptop from this particular lease-to-own store costing double or more than what it retails for elsewhere; if someone made every payment on the laptop, they would have paid three times it’s actual retail value.

Even someone who charges a $1,169 laptop on a credit card with a 29% interest rate because of poor credit would pay off the laptop in only 11 months after paying only $164 in total interest if they paid $130 a month towards the balance.

The rent-to-own company is laughing all the way to the bank. One such business made $30,000 renting the same laptop over and over again for years.

That’s not even the worst of it. As you are paying for an item, its value is depreciating. After a year and a half, that laptop would be worth maybe $300 if you are lucky as newer and faster models come out.

No wonder these types of stores were once branded as predatory lenders by the Department of Defense.

Better Choices Than Furniture and Appliance Rentals

A better solution to renting merchandise or products is to buy them used if you cannot afford new. We live in a consumer-driven economy where people are constantly getting rid of perfectly good things for stuff that is newer because they are moving, remodeling, or upgrading.

Two websites I’ve used successfully to purchase used items locally are Craigslist and Facebook Marketplace.

You can find appliances such as stoves, refrigerators, and washers and dryers going for a hundred dollars or two all day long on the online classifieds. You can find similar bargains for furniture. Comparing that to the prices one would pay at a rent-to-own center, you’ll be ahead after as little as two months.

I’ve purchased a used fridge for $100 and a gas stove for $75 for a family member’s rental that has been in use for over six years now. He definitely got his money’s worth there. There was also the $50 brand new dishwasher from Craigslist for my parents’ house along with two stoves for $100 and $69 each for a couple houses I was selling. All those appliances cost less than a month’s rent from the rent-to-own stores.

No truck to get your big purchases home? Go to Home Depot and rent a truck for $19 for the first 75 minutes and $5 for each additional 15 minutes. Or go to Uhaul and pay $19.95 for 24 hours plus $0.59/mile.

Some might argue that the merchandise at the rent-to-own store is better. Not really. The products for rent at the stores are used just like the items you buy from the classified ads. When people don’t pay their monthly fees, the item gets repossessed, cleaned up, and then put back on the sales floor. Same goes for the items customers return after deciding not to rent them anymore. The only real benefit is if it dies, you can get it replaced by the store.

Sometimes the items available for rent aren’t even that great. You can read rent-to-own employees’ stories on Reddit about what happens behind the scenes. One poster said they saw an employee spray painting a mattress white. Another employee wrote they once had to bug bomb everything they had repo’ed because it was infested with roaches.

Now there are some things I wouldn’t buy used unless I had no choice. One thing that comes to mind are mattresses. You can find thick memory foam mattresses on Amazon for a couple hundred dollars shipped directly to your door. When I rented an unfurnished apartment in a ski town for six months, I didn’t want to throw out a perfectly good mattress afterwards only to have to purchase a new one at my next destination so I purchased an Intex air mattress with a built-in air pump for $60.

Other places you can look for gently used items are garage sales, estate sales, thrift stores, and Goodwill.

Why Rent-To-Own Is So Popular

If leasing things is such a terrible deal, then why do people do it?

It is because in today’s times, everyone lives in the “now”. Everything is about instant gratification. They see something in a commercial, at an acquaintances’, or on some reality show featuring their favorite rapper, and they want it too. Most of the time, these things are not even a necessity.

Does someone really need that iPad? That stainless steel fridge? That big screen television and TV stand to put it on? Or that five-piece leather sectional?

Of course not.

Those things are wants and if you want something, you should save up for it and buy it instead of leasing it. If you cannot afford new, buy used.

I know used items don’t have the excitement as new. But which is better? Trying to live your best life by spending beyond your means or putting food on the table?

Closing $ense

Renting or leasing merchandise is one of the worst things you can do financially. When even charging an item to a credit card and making payments is a better deal than renting says a lot.

Before considering renting to own, crunch the numbers and see what you are really paying.

The rent-to-own stores are taking advantage of the people who can least afford it. They have to because they are in business to make money.

Renting also adds another monthly bill one must remember to pay. Should someone falls behind on their payments, this is yet another bill collector that will be hounding them by phone and knocking on the door looking to get their money.

The bottom line is if you cannot afford something, you should wait to purchase it. Make a small sacrifice now rather than pay a huge price later.

Do you have any experiences with rent-to-own centers? What did you rent? What was the situation that made you decide to go with them?