I’ve been waiting forty years to write this post. In a prior post, I wrote about all the money mistakes you should avoid in your twenties. The good thing about messing up in your 20’s is there is still plenty of time on your side to recover before retirement.

The consequences of bad financial choices in your thirties are a bit more serious. Your thirties are full of major life decisions such as marriage, settling into a career, having children, and maybe buying your first home, all of which could have lasting effects on the rest of your life.

We like to think there is plenty of time to get our financial ducks in a row. However, with all the things requiring your attention now that you are older, before you know it, you’ll wake up at forty and wonder where your thirties went.

Here are some financial pitfalls to watch out for and avoid in your thirties as you build the foundation for your forties and beyond to ensure that you are on track for a happy and successful life.

Table of Contents

Mistake #1 – Being Too Conservative In Your Career

Are you still working at the same company since graduating from college in your 20’s? You might feel that showing loyalty to your employer means better job security. After all, when the economy hits hard times, the first to go are usually the most recent hires.

The reality is there is no such thing as job security. I recently met someone who was a programmer for a big telecommunications provider and the entire department was let go last month. This had nothing to do with the new shelter–in-place policies from the pandemic but the layoffs were planned for a while. He suspected it was because everyone had been working there for almost a decade and they were all making too much money. For this reason, everyone should have an emergency fund, savings, a side hustle, or passive income from other sources in addition to their job’s income.

The drawback of sticking with one employer forever is it limits your wage growth. This is even truer if you started working at a company right out of college. You start off with a lower base salary, maybe get a few promotions, and then get stuck with 2-3% annual raises based on a percentage of your salary. Those annual increases just keep up with inflation, so you aren’t really getting a raise at all.

That was exactly what happened to a friend who worked up to be the top programmer at a small company he had joined after graduation. After over decade there, he was making in the mid $90k’s. When it looked like the company wasn’t doing that well and the office politics started to drag on him, he started looking elsewhere and landed another job that offered him $125k.

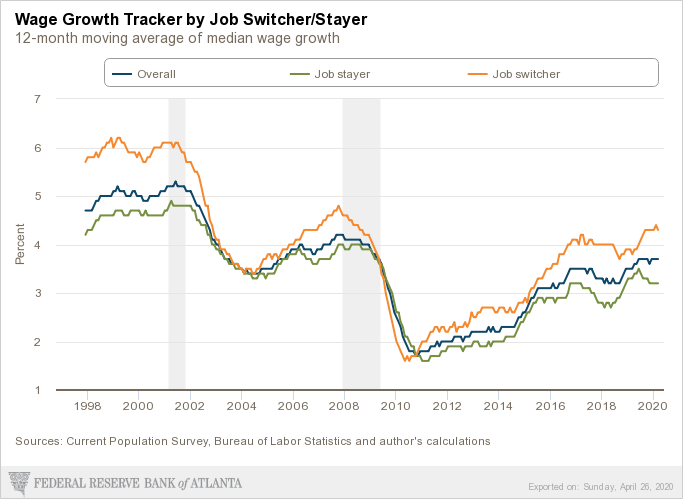

Data from the Federal Reserve Bank of Atlanta shows that job switchers almost consistently improve their wages more than people who stayed with the same company. In the most recent March 2020 data, job switchers got a 4.3% bump in salary compared to just 3.2% for people who didn’t switch jobs.

As seen in the above chart, where a recession is marked as grey bars, the largest gap between job switchers and job stayers is during the years when the economy is doing well. Companies are willing to pay more to compete for the best employees.

Once you get hired at a higher based salary, not only do you get paid more, your annual raises when calculated as a percentage of your salary, are bigger too.

When you are still young and don’t have kids and a mortgage to keep you rooted at your current employer and state, that is the best time to look around to see what else is available.

At the very least, go to Glassdoor or Indeed and see what salaries are being paid to people in your field and job title at other companies or even your own company. Make sure whatever you are earning is competitive.

Mistake #2 – Withdrawing Your Retirement Savings When Changing Jobs

You are a job hopper or you’ve taken my previous advice about seeing what jobs are available and you’ve found a better job. If you are thinking about cashing out your 401k from your old job – stop right now!

If you withdraw your 401k funds before 59.5, you will have to pay a 10% early withdrawal penalty in addition to income tax on the distribution.

In addition to losing money in penalties and taxes, you are giving up decades of compound growth when you cash out your 401k.

My advice is if you have an account with a small amount of money, your 401k has limited investment options or has high maintenance fees, go roll it over into a Rollover IRA. Doing so lets you retain the tax-deferred status of your retirement funds without paying penalties or income taxes.

Many brokerages, including those that offer free stock trades, offer Rollover IRAs. This will let you manage your money in one place, simplifying your investments. You will also likely get access to a larger variety of low fee funds and ETFs than some company 401k offerings.

When should you keep your 401k with your old company then? Assuming you have a larger 401k account from years of employment and the maintenance fees are low, then it wouldn’t hurt keeping it where it is. The benefit of a 401k is there are federal laws that protect them from creditors during both bankruptcy and non-bankruptcy judgments. Rolling over the funds from a 401k to an IRA retains unlimited bankruptcy protection as if the funds were in a 401k. However, state law dictates whether an IRA’s funds are accessible during non-bankruptcy judgments. If you are worried about getting sued, check with your state’s laws before rolling over your 401k to an IRA.

Mistake #3 – Prioritizing Saving For Your Children’s Education Than Your Retirement

I get it. College is expensive and as a parent, you want the best for your child.

If you had a newborn today, college costs will be astronomical 18 years from now when it’s time for them to enter college.

Vanguard has a nice College Cost Projector where you can enter in the years until college, years to earn a degree, the rate of annual cost increase, and the current college cost. Ignoring room and board, a year of tuition at my alma mater, a private university, is currently $53,800. In 18 years, at the current 5% average rate of inflation of college, it is projected to cost $129,500 for just the first year of tuition. For 4 years of private college education, it comes out to almost $560,000. Public university is not much cheaper, at about half the cost.

As much as we as parents want our children to start life without being burdened by a quarter to over half million dollars in student debt, you cannot ignore your retirement funding to pay for their college education.

There is an entire industry to help your kids pay for college. Your child can get or apply for a variety of scholarships, grants, financial aid, work-study programs, and student loans. If they qualify, there is public service loan forgiveness from the government for eligible federal student loans.

What help do you get to pay for retirement as a retiree?

There is Social Security, which may or not be able to pay its full benefits by the time we retire in 35-40 years. The Social Security Board of Trustees projects by 2035, the taxes collected will only be able to cover 75% of its scheduled benefits.

If you are extremely lucky, you might have a pension. With fewer and fewer employers offering pensions these days, I wouldn’t count on it. The jobs most likely to still offer pensions are state and federal government positions.

Those who own a paid off house or have property with a lot of equity can do a reverse mortgage.

That is pretty much it. There are no loans for retirement. If you don’t plan for your retirement, there will be no cushy retirement of playing golf all day. You will be either working as a greeter at Walmart into your 70’s or living in your son’s or daughter’s basement.

That said, after you’ve funded your retirement accounts and you still want to save for your kids’ college fund then do it. College is going to be expensive and the earlier you start putting money away, the better.

Mistake #4 – Spending Too Much On A Wedding

According to The Knot’s 2019 Real Weddings Study, the average cost of a wedding, including the engagement ring was $33,900. 70% of couples then spent an additional $5,000 on their honeymoon. To put that into perspective, $34,000 is the price of a brand new car or a 20% down payment on a $170,000 house.

While the wedding should be about the couple, many couples are tempted to put on a memorable event for their family and guests. It’s easy to think you’ll only get married once; this will be a one-time thing, and to go all out. The cost of entertainment and food at the reception can increase dramatically as the number of guests goes up.

A survey by LendingTree found that 45% of Americans went into debt to pay for their wedding. What was supposed to be the happiest day of their lives, results in the newlyweds starting their married life off on the wrong foot and saddled with bills that could take years to pay off. 47% of couples who went into debt for their nuptials say money has caused them to consider divorce.

Rather than borrowing money to pay for a wedding, set a reasonable budget, stick with it, and save for the wedding. There are many other small ways you can save money on a wedding, from trimming down your guest list, having your wedding during shoulder season, setting up a cash registry, skipping the Saturday wedding, and more. Or elope!

Mistake #5 – Not Discussing Finances Before Marriage

You think you’ve found The One. Before you take the trip down the aisle, sit down and have the money talk. Financial troubles and financial incompatibility are one of the major causes of divorce.

When you are married, your financial lives will be intertwined even if you don’t do joint bank accounts. You want to be in agreement on money matters and be sure there are no surprises. Once married, their debts become your debts too.

Discuss spending habits. Compare assets and debts. Ask how many kids they might want to have. Who will be in charge of paying the bills and investing for the future? How much savings do they have and are they saving for retirement? How do they feel about prenups and whether one is needed. Establish a dollar amount that requires joint consent for purchases. What happens if a spouse’s parents need financial assistance? What are their career plans? Will they work throughout the marriage or will they want to be a stay at home mom or dad. What are their short-term, mid-term, and long-term financial goals?

Everyone has different attitudes towards money. Some people are savers. Others are spenders. And some are in the middle. A spendthrift married to a penny-pincher doesn’t mean the marriage will be doomed. The spender can help the frugalist ease up and enjoy life more while learning to save for the future in return. The key is being on the same page and then moving forward as a team.

Mistake #6 – Not Being Adequately Insured

When you are young, you might not have enough assets or income to justify spending the money on insurance. This changes as you get into your 30’s and beyond. As you start to make more money, start a family, and your net worth goes up, you will want to make sure you are protected from the unexpected.

This means boosting your auto insurance liability coverage, getting disability insurance, signing up for life insurance, and maybe even buying umbrella insurance.

When I was 34, I switched my auto insurance from State Farm to Geico, and one of the first things I did was increase my liability coverage from $100,000 bodily injury limits per person, $300,000 total bodily injury liability to $250,000 per person and $500,000 total. Hospital emergency room visits are extremely costly and getting into a major accident that is my fault could wipe out all the years I spent saving. Getting 250/500 worth of coverage also meant I was able to get the same limits for uninsured and under-insured motorists. This type of coverage is extremely cheap and it protects you from all the other drivers on the road who have the absolute minimum insurance.

Read more: Understanding and saving money on auto insurance

When your assets get even higher, an umbrella insurance policy may start to make sense. This type of insurance supplements your other liability policies such as auto, homeowners, or renters insurance that you have. Because it only kicks in when those policies have been exhausted, you get a lot of coverage for not that much money, usually about $150 to $300 per year for $1 million in coverage. Each additional million costs less and less.

Consider this example of what happened to a woman in my area last year. She was on a motorcycle at night with her roommate on the back and a car made a left turn in front of their motorcycle’s path. Just her medical bills alone totaled $1.5 million dollars. If the car’s driver had $500,000 of liability coverage per person, they would have been on the hook for $1 million dollars. Assuming they had the foresight to get $1 million in umbrella coverage, their auto liability policy would have paid out $500,000 and their umbrella policy would have paid the remaining amount, averting financial ruin.

As your income potential goes up as your career progresses, disability insurance also becomes more important. You are more likely to become disabled than to prematurely die. Disability insurance is a must if you are in high earning professions such as doctors, dentists, or attorneys, where you are finally done with decades of expensive schooling and ready to start earning the big bucks. The last thing you need is accidentally breaking your wrist on a ski trip to Aspen and being unable to operate again as a neurosurgeon.

Then there is life insurance. When you have children and people depending on you, life insurance is important in case something happens to you. A quick rule of thumb is 10 times your yearly income. Even if you are a stay-at-home parent, you need life insurance because your spouse will need to find someone to provide child care and other services that you did for free.

The nice thing about insurance in your thirties is it doesn’t cost that much. Your auto insurance rates will have likely gone down as you are now over 25 or if you’ve gotten married. As a 30-something, you are still in relatively good health, which gets you lower life and disability insurance premiums.

Mistake #7 – Spoiling Your Children and Teenagers

A baby or toddler does not need designer clothes. They don’t know what Gucci, Fendi, Burberry, or Givenchy is and could not care less. They will be just as happy running around wearing only diapers. Parents who buy name brands for their kids are mainly doing it to impress other parents. Babies grow up so fast, by next year everything in their wardrobe won’t fit anymore and you are going to have to buy it all over again anyway.

The same goes for all the other baby accessories. It is easy to go overboard for your first child. Expensive doesn’t mean it’s good. You don’t need the top range strollers, cribs, car seats, toys, diaper bags, walkers, etc. Buy what gets you the most value for your money.

Once kids get older and turn into teenagers, the pressure from their peers on having the latest fashions, iPhones, and technological gadgets such as game consoles, laptops, and more can place huge financial demands on parents. Then they turn 16 and want their driver’s license and first car along with the expensive insurance that comes with driving at that age.

Think back to when you were young and how much you wanted a particular toy or game that you thought you couldn’t live without like it was going to change your life. Once you got it, you may have played with it for a few months before forgetting about it entirely once the novelty wore off.

As parents, we need to explain that money does not grow on trees and we can’t always have everything that we want. If they want something, they need to learn about delayed gratification and the rewards of hard work. You don’t want to deprive them of their childhood, but don’t go overboard either.

Mistake #8 – Buying Too Much House

After living in apartments in your 20’s and hearing your upstairs neighbor stomping back and forth every night at midnight, you might be thinking it’s time to stop ”throwing money away” renting and to buy a house instead.

For the majority of people, your house will be the largest purchase of your life, a purchase that could take up to 30 years to pay off. The general rule of thumb is to keep your housing expenses (rent or mortgage) to no more than 28% of your gross before-tax income.

Read more: Why consider a 30 year mortgage over a 15 year one

The latest data from the U.S. Census Bureau shows that the average sale price of a house as of the fourth quarter of 2019 was $382,300. That is higher than the prices before the Great Recession. Meanwhile, home sizes have increased from 1,660 square feet in 1973 to 2,559 square feet in 2018.

The larger the house, the more it costs to heat and cool. It will also mean spending more to furnish and fill all the rooms. A more expensive house means higher property taxes and insurance. Nicer homes tend to be in neighborhoods with HOAs, which means another fee to pay each month.

The bank might say that you can afford a five bedroom house, but when you can make do with a three bedroom for your family of four; there is no need to spend all that extra money for space that will never be used. The bank approving you for a giant mortgage doesn’t mean you need to use it all. Stick with what is in your budget.

Ignore the houses your realtor insists on showing you outside your desired price range since they earn a commission based on the sale price.

Finally, consider putting a 20% down payment if possible. Even though some loans require as little as 3.5% down or even 0% for VA loans, there are benefits for putting down 20%. Not only do you save money on private mortgage insurance; you will have a lower monthly payment; you are likely to get more lenders competing for your business, resulting in lower mortgage interest rates.

Closing $ense

Take advantage of your thirties. It is a great decade from a personal growth and financial perspective. Your job may have turned into a career that earns more income. You are more mature, confident, and may be on your way to starting a family or getting married if you haven’t already.

This also may be the last decade where you can still get double digit returns for every dollar saved. One dollar saved at 8% annual rate of return yields over $16 after 35 years when compounded monthly.

Avoiding these mistakes will set you on a more solid foundation than your peers who aren’t planning ahead. Hard work may pay off, but remember, it’s not how much money you make, but how much you save. Keep more of your money by being smarter.

What are some mistakes you made or you’ve noticed people making in their thirties?